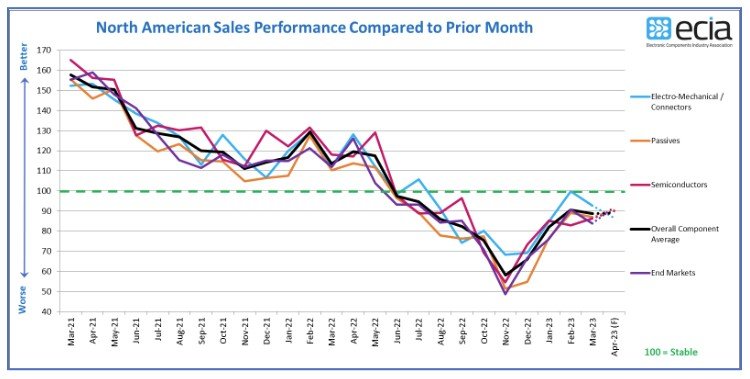

According to ECIA's latest Electronic Components Sales Trend (ECST) survey, the electronic components Sales Trend index surged in February, but cooled in March. In the February survey, respondents had expected sales sentiment to improve in March. However, the actual result in March was a 2-point drop in overall sentiment to 88.6.

Component sales: Cooling off

"The sales trends index has continued to rise from its low point in November 2022, with encouraging growth in the following three months," Dale Ford, chief analyst at ECIA, said in a statement. The biggest monthly increase over the period was February 2023, with an overall increase of 32.6 points to 90.6, the best level since July 2022. So the two-point drop in March was a small pullback by comparison.

He added: "Overall, the latest sentiment index for electronic components shows a continued decline in sales." "However, these results would still suggest a soft landing in the current cycle."

Notably, market weakness is leading to shorter delivery times, which is good news for downstream buyers.

The ECIA report said the confidence index is likely to hold steady at 88 points in April, rising slightly to 89.1. Among them, the outlook of mechanical and electrical parts is increasingly pessimistic, as the business index reached a high level again in March, but fell sharply from the high of 99.9 in February to 92.7; The April confidence index will continue to fall to 86.7.

On the other hand, the performance of semiconductors improved in March as the index rose from 82.9 to 86.3. This improving index score is reflected in the April outlook, with an expected score of 90.0.

Passive component confidence is relatively stable, falling 2.1 points in March, and is expected to rebound to 90.5 in April.

End market: mixed

According to the ECIA data, the end market results of the March survey followed the trend of the sub-survey, with the overall index falling 4.2 points. There is a sharp contrast between the various market segments. The sectors with the highest scores all saw declines, with medical electronics falling below 100.

Avionics/military/Aerospace, automotive and industrial can maintain a score of 100+. Despite the chip shortage, electric vehicles are driving optimism in the auto market, according to Supplyframe. According to Bloomberg, all-electric vehicles will account for 7 percent of North American vehicle production by the end of 2022, up from 4.7 percent the year before.

Ford said the most positive news in the end-market results was a strong rebound in three of the weaker markets: computers, consumers and telecommunications and mobile phones. Indices for these segments jumped in a range of 9.2 to 16.1.

Telecommunications networks ranked lowest among all market segments at 74.6.

The survey also found that delivery times are shrinking. In March, 43 percent of respondents said delivery times were shorter, compared with 37 percent in February. In addition, the number of respondents who said delivery times have decreased or stabilized increased from 90 percent to 96 percent. Only 2% of respondents thought delivery times had increased.

Weak market demand is clearly the main reason for the dramatic improvement in delivery times. However, Ford also credited the increase in production. "Given that inventory overhang is currently the biggest challenge facing the supply chain, product mix issues appear to be the main driver of increased delivery times as inventory balances in a declining market," he concluded.